Fannie and Freddie’s boards of directors bear more responsibility than has otherwise been cast upon them regarding the 2008 conservatorships.

How is it possible that a Board with fiduciary responsibly to shareholders would give away their companies in a one-hour meeting (as the Government claims)? The directors would have known better than anyone that their companies did not meet any of the conditions necessary for FHFA to place them into conservatorship.

Under HERA, FHFA was authorized discretionary authority to place Fannie and Freddie into conservatorship if one of the following conditions existed:

(A) ASSETS INSUFFICIENT FOR OBLIGATIONS

(B) SUBSTANTIAL DISSIPATION

(C) UNSAFE OR UNSOUND CONDITION

(D) CEASE AND DESIST ORDERS

(E) CONCEALMENT

(F) INABILITY TO MEET OBLIGATIONS

(G) LOSSES

(H) VIOLATIONS OF LAW

(I) CONSENT

(J) UNDERCAPITALIZATION

(K) CRITICAL UNDERCAPITALIZATION

(L) MONEY LAUNDERING

The Boards knew none of the above conditions existed. As I have asserted in previous posts Fan and Fred boards did not consent to conservatorship…they merely acquiesced. Which basically means the boards agreed in silence. Acquiescence is not on the above list… and it differs from consent.

Why were the board directors silent over the conservatorships? How could the Government gain their silence?

Perhaps it was presented like this, “If you fight us; we fight you.”

“Agree and we’ll leave you alone. Disagree and we will go after you personally. Agree, and Paulson and Lockhart will proclaim that the problems beset upon Fan and Fred were not the directors’ fault. However, if you want to fight, the Government will not only blame you directors, but we will press charges against you.”

The following passages are FHFA and Treasury announcements about the conservatorships:

James Lockhart’s announcement:

“The Boards of both companies consented yesterday to the conservatorship. I appreciate the cooperation we have received from the boards and the management of both Enterprises. These individuals did not create the inherent conflict and flawed business model embedded in the Enterprises’ structure.”

“I appreciate the productive cooperation we have received from the boards and the management of both GSEs. I attribute the need for today’s action primarily to the inherent conflict and flawed business model embedded in the GSE structure, and to the ongoing housing correction. GSE managements and their Boards are responsible for neither.”

According to an article in the Washington Post,

“(Fannie Mae CEO Daniel) Mudd and (Freddie Mac CEO Richard) Syron said their companies could weather the downturn, but recently the government, reviewing the companies’ books, disagreed. Last weekend, (FHFA Director) Lockhart and Treasury Secretary Henry M. Paulson Jr. seized Fannie Mae and Freddie Mac and named new chief executives.”

Apparently, of all the directors of both Fan and Fred, Daniel Mudd was the person most against the conservatorships. And Mr. Mudd is the only director that the Government continues to prosecute to this day. Coincidence?

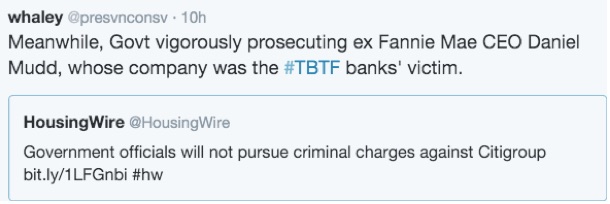

This tweet captures the thought:

Certainly, it appears that the Government selects whom it wants to prosecute…not for legal reasons, rather for political ones.

David Fiderer in a blog post yesterday states Daniel Mudd asserts that “the SEC’s charges are utterly devoid of merit…’”

The following is an example of the instrument that the Government uses to keep people quiet:

UNITED STATES OF AMERICA SECURITIES AND EXCHANGE COMMISSION NON-PROSECUTION AGREEMENT

“PUBLIC STATEMENTS

8. The Respondent agrees not to take any action or to make or permit any public statement through present or future attorneys, employees, agents, or other persons authorized to speak for it (“Related Person”), except in legal proceedings in which the Commission is not a party, denying, directly or indirectly, any aspect of this Agreement or creating the impression that the statements in Exhibit A to this Agreement are without factual basis. This paragraph is not intended to apply to any statement made by an individual in the course of any criminal, civil, or regulatory proceeding initiated by the government or self-regulatory organization against such individual, unless such individual is speaking on behalf of the Respondent.

If it is determined by the Commission that a public statement by the Respondent or any Related Person contradicts in whole or in part this Agreement, at its sole discretion, the Commission may bring an enforcement action in accordance with Paragraphs 15 through 18, but only provided that

Respondent does not cure the statement by promptly making appropriate public statements or court filings satisfactory to the Commission after a reasonable opportunity to do so by the Commission.

9. Prior to issuing any press release concerning this Agreement, the Respondent agrees to have the text of the release approved by the staff of the Division”

The agreement is simple – the Government will not prosecute in return for silence. It seems logical to assume that the Government also entered into similar agreements with senior management, which could help explain the lack of whistleblowers from either company.

Knowing they silenced the most credible witnesses through threat and coercion, the Government argued in their motion to dismiss in the Perry case:

“Since the plaintiffs have not demonstrated, through their pleadings, that FHFA acted in bad faith, Delaware case law under which discretionary dividends will only be compelled in the rare instance of a judicial finding of “fraud or gross abuse of discretion” by the board of directors is inapposite…”

“Unless the plaintiffs can demonstrate that FHFA could not legally impose a conservatorship upon the GSEs at the time of the Third Amendment, allegations of mischievous intentions during a conservatorship do not revive already eliminated cognizable property interests. See id. And here, the class plaintiffs only plead that the Third Amendment was inconsistent with FHFA’s responsibilities as conservator— not that FHFA lacked any legal right to be a conservator on August 17, 2012.”

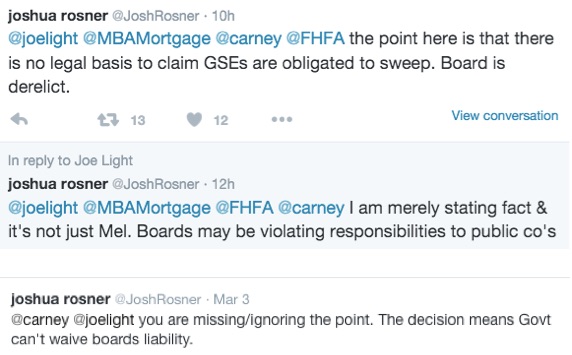

Further, Josh Rosner has recently been stressing that the current boards may be in breach of their fiduciary responsibilities to shareholders, too.

Josh’s point is FHFA can only exercise those powers of the original boards… nothing more and nothing less. As Josh states, the current boards are still responsible for their decisions…especially ones regarding the Sweep Agreement.

This current sentiment regarding board culpability is based largely on two lawsuits. The 9th District recently ruled in Adams v. Aurora Loan Services that Fan and Fred are still considered private companies despite being in conservatorship under Federal Housing Finance Agency. This 9th District ruling has bearing in the Jacobs v. FHFA where the plaintiffs claim actions violate state laws.

These violations of state law pertain to the dividend payments. However, the PSPAs state that dividends will only be paid if the boards declare them. Therefore, the Boards bare responsibility in violating state laws each time they declare and pay the dividends to Treasury.

Good advice states that when you’re robbed at gunpoint (bazooka), the best action is to hand over your money and don’t fight. Perhaps that best explains what happened with the Boards. Plus, how many directors had the emotional and financial wherewithal to fight the US Government? That effort would put yourself and your family through hell.

Wishing Daniel Mudd the best of luck in his continued struggle with the Government…

I’ll end by quoting Tim Howard as posted on his blog:

“Conventional wisdom is that it will be difficult to successfully challenge Treasury’s decision to take the companies over, because of the deference courts give to regulatory actions during times of crisis. But this instance should be an exception. As we have detailed elsewhere, Treasury’s decision to take Fannie and Freddie over was not a rescue, made amidst the “fog of war;” it was a well-planned and meticulously executed strategy to expropriate the assets of two shareholder-owned companies for policy purposes, including ensuring that banks and other lenders had reliable outlets for their mortgages, and buying time for Treasury to do true rescues (or “bailouts”) on an advantaged basis for the troubled institutions that it favored.

Why had there been a paper about nationalizing Fannie and Freddie circulating at Treasury six months before that happened? Why would both the Fed and the Treasury have declined to use their existing authorities to make secured, riskless loans to the companies, had they ever been needed? Why would Paulson have held a secret meeting with hedge fund managers in July 2008 to tell them Treasury was considering putting Fannie and Freddie in conservatorship and wiping out their shareholders? Why would Treasury have inserted a clause in the GSE reform bill that made Fannie and Freddie directors immune from shareholder lawsuits if they gave in to pressure and let the government take the companies over for no statutory reason? Why would Paulson withhold from the companies’ CEOs and directors the terms of the “rescue” he was insisting they agree to? And what possible reason could there have been for making Fannie and Freddie take non-repayable senior preferred stock to offset even temporary shortfalls in their capital”?

excellent article Fanofred as you always do!

LikeLike

Thank you. Glad you enjoyed!

LikeLike

Pingback: Happy Labor Day America! | thetruthaboutfannieandfreddie

Pingback: March 2016 - GSE Links